postmates tax form online

According to Postmates if you dont meet this requirement you wont receive a 1099. This app makes keeping track of my tax deductions a breeze.

The Ultimate Guide To Taxes For Postmates Stride Blog

22000 Total tax to pay.

. However if you have other income over 12200 from. Try it free with a 7-day free trial cancel. If you are expected to owe the IRS 1000 or more when you file taxes then you need to make quarterly estimated income payments.

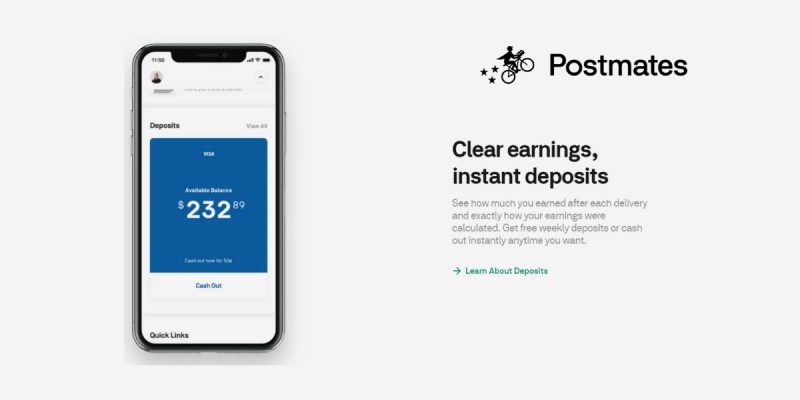

Postmates has joined Uber Eats which means customers and delivery requests have switched to the Uber app as of June. If you earned more than 600 youll receive a 1099. As a Postmates delivery driver youll receive a 1099 form.

Postmates will only prepare a 1099-NEC for you if your earnings exceed 600 in a year. 12200 if under age 65. Here you will add up how much money you received for your delivery work.

Press J to jump to the feed. After I applied I got an e-mail telling me to schedule myself for an onboarding session. With Postmates Unlimited you get free delivery with no blitz pricing or small cart feesever.

PostmatesUber Tax Form 1099 Help. Postmates drivers are self-employed. Postmates online application.

Americas 1 tax preparation provider. As a Postmates independent contractor you are responsible for keeping track of your earnings and accurately reporting them in tax filings. This is where you enter your earnings from Grubhub Doordash Uber Eats and others.

News and discussion about the delivery company Postmates. The 1098-T form will give you up to 1000 dollars refund if you went to school like I did. A 1099 form is an information return that shows how much you were paid.

Postmates Tax Deductions Back Story. How to Handle Taxes. In this Video I try my best to explain Postmates taxes.

I completed the Postmates application online. Since Postmates has been acquired by Uber youll need to reach out to Uber for your 1099. Use This Free Spreadsheet for Your Independent Contractor Expenses.

This means Postmates drivers are eligible for Postmates 1099 tax write-offs such as self. Your earnings exceed 600 in a. Typically you should receive your 1099 form before January 31 2021.

4000 Expense deduction based on 30K. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Its gone from a chore to something I look forward to.

The Complete Guide to Filing Your Postmates 1099 Taxes. Get help with your Uber account a recent trip or browse through frequently asked questions. 529k members in the postmates community.

Postmates will send you a 1099-NEC form to report income you made working with the company. Press question mark to learn the rest of the keyboard. When To File Postmates 1099 Taxes.

Then from there you can click on Tax Documents and if they did a 1099 for you you can download it there. IRS Tax Forms For A Postmates Independent Contractor. Single filing status.

You dont have to file. I can no longer go online in my Postmates Fleet app. Watching my deductions grow.

While Stride operates separately from Postmates I can tell you that Postmates will only prepare a 1099-MISC for you if. Therefore if that 25 is the only income you have. So if you have determined that you are a contractor you can always call and ask Postmates then you will have to file a Schedule C on your tax return in TurboTax this is the.

Stride is a cool and free new option for. Unlimited free deliveryonly for Unlimited members. From how to pay your postmates taaxes to what write offs you can claim with postmates.

How To Get Your 1099 Form From Postmates

Postmates Announces New Grocery Delivery Service Fresh Alongside Ios App Redesign Updated Macrumors

Postmates 1099 Taxes The Last Guide You Ll Ever Need

Postmates Taxes The Complete Guide Net Pay Advance

.png)

Postmates 1099 Taxes The Last Guide You Ll Ever Need

How To Get Your 1099 Form From Postmates

Postmates Driver Review 2022 Make Money Delivering Stuff

Postmates 1099 Taxes The Last Guide You Ll Ever Need

How Do Food Delivery Couriers Pay Taxes Get It Back

How Do Food Delivery Couriers Pay Taxes Get It Back

The Ultimate Guide To Taxes For Postmates Stride Blog

How To Get Postmates Tax 1099 Forms Youtube

How Postmates Will Help Uber Eats Turn Profitable

The Ultimate Guide To Taxes For Postmates Stride Blog

S 4 A 1 E20497 Uber S4a1 Htm As

How To Record Postmates Sales In Quickbooks Youtube

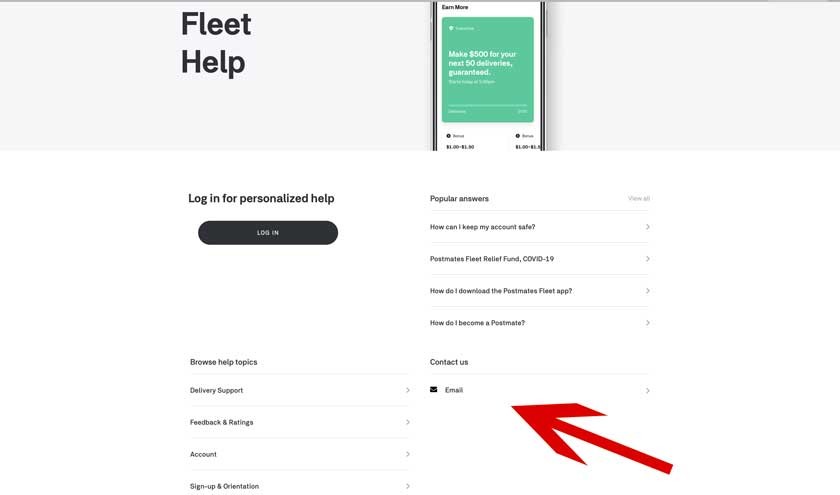

4 Easy Ways To Contact Postmates Driver Customer Support